The Best Guide to Robinhood Day Trading - Strategies, Risks, and Tips

Robinhood day trading has become a popular way for traders to buy and sell stocks, options, and cryptocurrencies within the same day. With zero-commission trading, an easy-to-use interface, and access to real-time market data, Robinhood attracts both beginners and experienced traders. However, day trading on Robinhood comes with specific rules, risks, and strategies that day traders must understand to succeed.

What is Robinhood Day Trading?

Day trading involves buying and selling financial instruments within a single trading day. The goal is to capitalize on short-term price movements. Robinhood, a commission-free brokerage, provides an accessible platform for day traders, but it enforces the Pattern Day Trader (PDT) rule, which limits the number of day trades for accounts with less than $25,000.

Key Features of Robinhood for Day Trading

Commission-Free Trading: No fees on stocks, options, and cryptocurrencies.

Easy-to-Use Mobile App: A streamlined interface for quick trades.

Real-Time Market Data: Essential for analyzing price movements.

Robinhood Gold: Provides access to margin trading and advanced research tools.

Understanding the Pattern Day Trader (PDT) Rule

The PDT rule is a regulation that applies to traders who execute four or more day trades within five business days using a margin account. If your account balance is below $25,000, you will be restricted from further day trading until the balance is replenished.

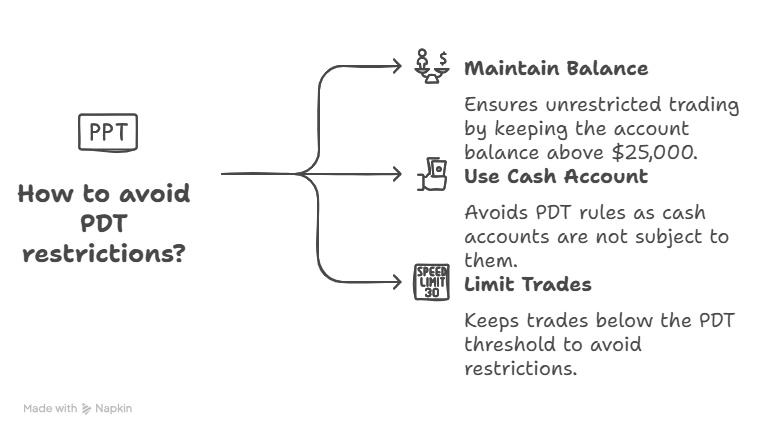

How to Avoid PDT Restrictions

Maintain a Balance Above $25,000: This ensures unrestricted trading.

Use a Cash Account: Cash accounts are not subject to PDT rules.

Limit Your Trades: Keep trades below the PDT threshold.

Best Strategies for Robinhood Day Trading

Momentum Trading Momentum traders focus on stocks experiencing significant price movement and high volume. They capitalize on short-term trends by entering trades at breakout points and exiting before momentum fades.

Scalping Scalping involves making multiple small trades throughout the day to profit from minor price movements. This strategy requires quick execution and real-time market analysis.

News-Based Trading Traders who use news-based strategies react to earnings reports, economic announcements, and breaking news that can cause rapid stock price changes.

Support and Resistance Trading This strategy involves identifying key support and resistance levels and executing trades when the stock price approaches these levels.

➡️ Interested in exploring another powerful trading platform? Read Mastering the Art of Webull Day Trading: Your Complete Guide to Success to learn advanced strategies for trading on Webull.

Common Risks of Day Trading on Robinhood

High Volatility Day traders rely on price fluctuations, but extreme volatility can lead to unexpected losses.

Margin Trading Risks Using margin can amplify gains but also increases the risk of significant losses if trades go against you.

Execution Delays Due to high trading volumes, Robinhood users may experience execution delays, which can impact trade outcomes.

Emotional Trading Impulsive decisions driven by fear or greed often lead to losses. It’s crucial to follow a disciplined strategy.

Pro Tips for Successful Robinhood Day Trading

Use Stop-Loss Orders: Protect your money by setting automatic exit points.

Stay Updated: Follow market trends, earnings reports, and financial news.

Practice with a Paper Trading Account: Hone your skills without risking real money.

Start Small: Avoid overleveraging your trades when starting out.

Learn More:

For more insights into stock trading strategies, consider checking out this helpful book on Amazon: Stock Trading on Robinhood: Strategies for Success.

Conclusion

Robinhood day trading offers exciting opportunities for traders willing to learn and apply strategic techniques. However, it also comes with inherent risks that require careful management. By understanding the PDT rule, implementing sound strategies, and managing risks effectively, day traders can improve their chances of success.

Disclaimer: Trading stocks, options, and cryptocurrencies involves significant risk and may not be suitable for all investors. Past performance does not guarantee future results. Always conduct your own research and consult with a financial advisor before making investment decisions.

Frequently Asked Questions (FAQs) About Robinhood Day Trading Rules

1. Can you day trade on Robinhood?

Yes, you can day trade on Robinhood, but your ability to do so depends on your account type and balance. Margin accounts with less than $25,000 are subject to the Pattern Day Trader (PDT) rule, limiting them to three day trades within a rolling five-day period. Cash accounts are not subject to PDT restrictions but must wait for funds to settle before making new trades.

2. What is the Pattern Day Trader (PDT) rule on Robinhood?

The PDT rule applies to margin accounts with less than $25,000 in equity. It limits traders to three day trades within a five-business-day rolling period.

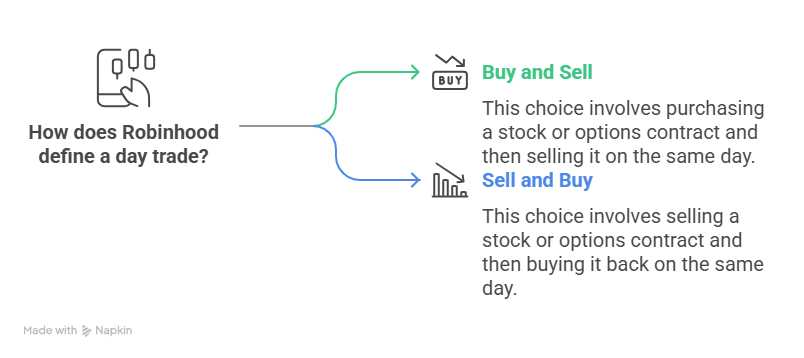

3. How does Robinhood define a day trade?

A day trade occurs when you buy and sell (or sell and buy) the same stock or options contract on the same trading day.

4. What happens if I make more than three day trades in five days?

If your account has less than $25,000, Robinhood will flag you as a Pattern Day Trader (PDT) and restrict you from making further day trades until your account meets the required balance.

5. Can I reset my PDT status on Robinhood?

Yes, you can request a one-time PDT reset if your account has been flagged. However, this is a one-time exception, and further violations will result in a trading restriction.

.png)

6. Does the PDT rule apply to cash accounts?

No, cash accounts are not subject to the PDT rule. However, they are limited by settlement times, meaning you must wait for funds to settle before making new trades.

7. Can I get around the PDT rule on Robinhood?

The only way to avoid the PDT rule is to:

Maintain a $25,000 balance in your margin account.

Use a cash account instead of a margin account.

Limit your trades to three day trades per rolling five-day period.

8. How long does a PDT restriction last?

A PDT restriction typically lasts 90 days, but you can remove it by maintaining an account balance of $25,000 or more.

9. What is Good Faith Violation (GFV) on Robinhood?

A Good Faith Violation (GFV) occurs when you sell a stock before the purchase funds have settled in a cash account. Too many GFVs can result in trading restrictions.

10. Does Robinhood allow unlimited day trading?

Only accounts with $25,000 or more in equity can make unlimited day trades without restrictions.

11. Can I switch from a margin account to a cash account to avoid the PDT rule?

Yes, you can switch to a cash account, but keep in mind that cash accounts require you to wait for trade settlements before reinvesting funds.

Related Articles

****Mastering the Art of Webull Day Trading: Your Complete Guide to Success

****The Ultimate Daily Trading Cryptocurrency Guide: Tips, Strategies, and Risks